59

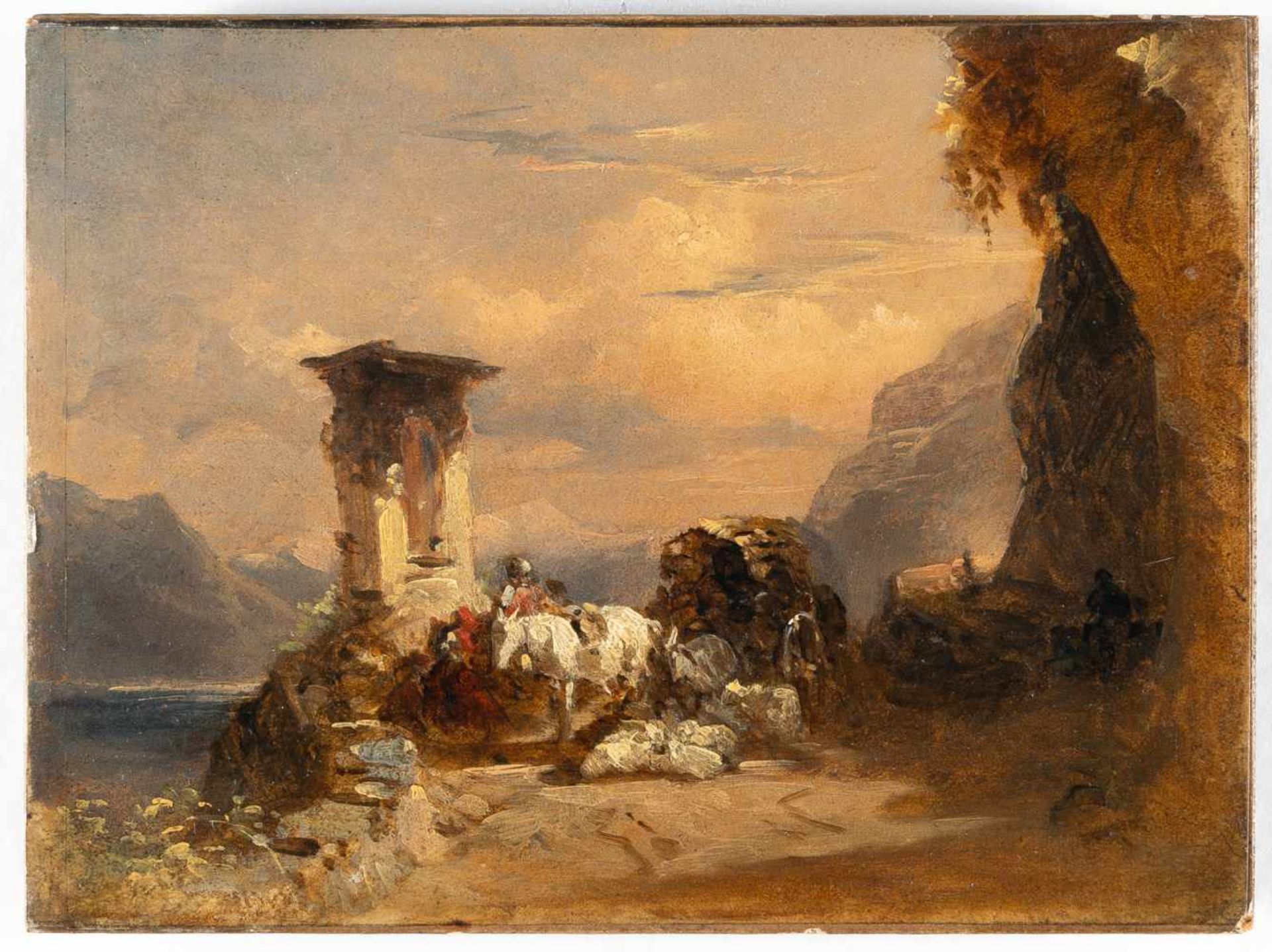

Friedrich Gauermann

Friedrich Gauermann

1807 Scheuchenstein - Wien 1862

Rast am Gardasee

Öl auf Velin, auf Holz aufgezogen. 15 x 20 cm.

Die Ölskizze nahm im Werk Friedrich Gauermanns eine gewichtige Rolle ein, dokumentiert sie doch einerseits seine tiefgreifende Verbundenheit mit der Natur, andererseits sein malerisches Potential. Bereits in der Umgebung seiner Miesenbacher Heimat war er von seinem Vater zum Zeichnen in der Natur angehalten worden und schon früh treten in seinem Werk in Ölfarbe auf Papier ausgeführte Naturstudien von Menschen und Tieren, von Pflanzen und Bäumen, von Landschaften und Genreszenen auf. Zur letzteren Gattung gehört unser kleines Gemälde, das eine Gruppe von Landleuten am Gardasee zeigt. Die stimmungsvolle, in südliches Licht getauchte Szenerie erzählt von einer Gruppe von Landleuten, die ihren Weg auf einer hochgelegenen Uferstraße unterbrochen haben, um an einer Votivkapelle zu rasten. Mehrere Personen scheinen sich vor ihr niedergelassen zu haben, größtenteils verdeckt durch einen Schimmel, während das Fuhrwerk offenbar von zwei weiteren, kaum erkennbaren Pferden (oder Maultieren?) gezogen wird. Davor ruhende Schafe vervollständigen das Bild der pittoresken Reisegruppe. Die skizzenhafte, offene Malweise Gauermanns erschwert eine genauere Kenntnis der Figuren, die er allerdings auch nicht beabsichtigt. Aus der sicher und locker skizzierten Gruppe leuchtet ein kräftiger Farbklang von Weiß, Rot und Blau heraus, der sich von der erdigen Farbigkeit des Vordergrundes abhebt. Dem Hintergrund mit dem von Bergen umstandenen See und dem von der Sonne beschienenen Himmel widmet Gauermann große malerische Aufmerksamkeit, denn er vermittelt die gewünschte atmosphärische Stimmung – nicht ohne weiteres ist dabei zu entscheiden, ob es sich um eine Abend- oder Morgenstimmung handelt. Die sich im Laufe des Tages wandelnden atmosphärischen Erscheinungen im Bild auf Leinwand oder Papier zu bannen, war die Aufgabe solch spontan hingeworfener Ölstudien. Gauermann hat das Motiv in Öl noch zweimal in ähnlicher Weise wiederholt (Bozen, Landesmuseum, Inv. Nr. S. M. 50HOP.130, und Wien, Akademie der bildenden Künste, Kupferstichkabinett, Inv. Nr. 7139). Im Frühjahr 1838 war Gauermann das erste Mal nach Italien gereist; von Triest ging die Reise über Venedig nach Südtirol. Auf dem Weg dorthin auf einer Zwischenstation besuchte er zusammen mit Joseph Höger in Rovereto den befreundeten Dilettanten Domenico de Ballarini, bei dem sie auch Quartier nahmen. Gauermann war von Rovereto begeistert und berichtete dem befreundeten Kupferstecher Friedrich Wilhelm Fink in Wien, dass er „ziemliche Studien zu einem originellen Bilde gemacht [habe]. Nämlich gerade jetzt ziehen ganze Karawanen von Hirten, die von Mantua kommen, hier durch, um den Sommer auf den südlichen Tiroleralpen zu verleben, die hier rasten, im freyen vor Rovereto bleiben und dann wieder weiter ziehen. Das ist äußerst malerisch, ganz eigene Wagen mit zwey Rädern, Maulthiere, ganze Scharen Esel mit jungen, hunderte von den schönsten Schafen und Ziegen und die Tracht auch originell. Gleich wird eine solche Siesta angefangen, bei einer Abendbeleuchtung, die ich hier so schön gesehen habe. Mehrere Skizzen mitten unter Ihnen gezeichnet.“ (Zitiert nach Rupert Feuchtmüller: Friedrich Gauermann 1807-1862, Rosenheim 1987, S. 38). Die geschilderten Eindrücke hat Gauermann genauso in einem Skizzenbuch festgehalten wie einen Besuch am Gardasee (Wien, Albertina Museum, Inv. Nr. 30583). Er verwendete diese Studien für seine Ölskizzen und weitere drei bisher bekannt gewordene Zeichnungen (St. Pölten, Niederösterreichisches Landesmuseum, Inv. Nr. 1064r und 1064v; Graz, Universalmuseum Joanneum, Neue Galerie, Inv. Nr. II/9915; Wien, Kunsthandel Hassfurther, Auktion 27.5.1999, Los 17). Die intensive Beschäftigung mit dem Thema, die Ausarbeitung der Bildidee in Zeichnung und Ölstudien lassen vermuten, dass Gauermann eine Ausführung als Gemälde plante, doch ist eine solche bislang unbekannt.

Kunsthandel H.O. Miethke, Wien, verso mit Etikett; Privatbesitz, Deutschland.

Friedrich Gauermann

1807 Scheuchenstein - Wien 1862

Vantage point on Lake Garda with the shrine to the Virgin and hor

Oil on wove, laid down on panel. 15 x 20 cm.

Die Ölskizze nahm im Werk Friedrich Gauermanns eine gewichtige Rolle ein, dokumentiert sie doch einerseits seine tiefgreifende Verbundenheit mit der Natur, andererseits sein malerisches Potential. Bereits in der Umgebung seiner Miesenbacher Heimat war er von seinem Vater zum Zeichnen in der Natur angehalten worden und schon früh treten in seinem Werk in Ölfarbe auf Papier ausgeführte Naturstudien von Menschen und Tieren, von Pflanzen und Bäumen, von Landschaften und Genreszenen auf. Zur letzteren Gattung gehört unser kleines Gemälde, das eine Gruppe von Landleuten am Gardasee zeigt. Die stimmungsvolle, in südliches Licht getauchte Szenerie erzählt von einer Gruppe von Landleuten, die ihren Weg auf einer hochgelegenen Uferstraße unterbrochen haben, um an einer Votivkapelle zu rasten. Mehrere Personen scheinen sich vor ihr niedergelassen zu haben, größtenteils verdeckt durch einen Schimmel, während das Fuhrwerk offenbar von zwei weiteren, kaum erkennbaren Pferden (oder Maultieren?) gezogen wird. Davor ruhende Schafe vervollständigen das Bild der pittoresken Reisegruppe. Die skizzenhafte, offene Malweise Gauermanns erschwert eine genauere Kenntnis der Figuren, die er allerdings auch nicht beabsichtigt. Aus der sicher und locker skizzierten Gruppe leuchtet ein kräftiger Farbklang von Weiß, Rot und Blau heraus, der sich von der erdigen Farbigkeit des Vordergrundes abhebt. Dem Hintergrund mit dem von Bergen umstandenen See und dem von der Sonne beschienenen Himmel widmet Gauermann große malerische Aufmerksamkeit, denn er vermittelt die gewünschte atmosphärische Stimmung – nicht ohne weiteres ist dabei zu entscheiden, ob es sich um eine Abend- oder Morgenstimmung handelt. Die sich im Laufe des Tages wandelnden atmosphärischen Erscheinungen im Bild auf Leinwand oder Papier zu bannen, war die Aufgabe solch spontan hingeworfener Ölstudien. Gauermann hat das Motiv in Öl noch zweimal in ähnlicher Weise wiederholt (Bozen, Landesmuseum, Inv. Nr. S. M. 50HOP.130, und Wien, Akademie der bildenden Künste, Kupferstichkabinett, Inv. Nr. 7139). Im Frühjahr 1838 war Gauermann das erste Mal nach Italien gereist; von Triest ging die Reise über Venedig nach Südtirol. Auf dem Weg dorthin auf einer Zwischenstation besuchte er zusammen mit Joseph Höger in Rovereto den befreundeten Dilettanten Domenico de Ballarini, bei dem sie auch Quartier nahmen. Gauermann war von Rovereto begeistert und berichtete dem befreundeten Kupferstecher Friedrich Wilhelm Fink in Wien, dass er „ziemliche Studien zu einem originellen Bilde gemacht [habe]. Nämlich gerade jetzt ziehen ganze Karawanen von Hirten, die von Mantua kommen, hier durch, um den Sommer auf den südlichen Tiroleralpen zu verleben, die hier rasten, im freyen vor Rovereto bleiben und dann wieder weiter ziehen. Das ist äußerst malerisch, ganz eigene Wagen mit zwey Rädern, Maulthiere, ganze Scharen Esel mit jungen, hunderte von den schönsten Schafen und Ziegen und die Tracht auch originell. Gleich wird eine solche Siesta angefangen, bei einer Abendbeleuchtung, die ich hier so schön gesehen habe. Mehrere Skizzen mitten unter Ihnen gezeichnet.“ (Zitiert nach Rupert Feuchtmüller: Friedrich Gauermann 1807-1862,

Full description on lot-tissimo.com

Friedrich Gauermann

1807 Scheuchenstein - Wien 1862

Rast am Gardasee

Öl auf Velin, auf Holz aufgezogen. 15 x 20 cm.

Die Ölskizze nahm im Werk Friedrich Gauermanns eine gewichtige Rolle ein, dokumentiert sie doch einerseits seine tiefgreifende Verbundenheit mit der Natur, andererseits sein malerisches Potential. Bereits in der Umgebung seiner Miesenbacher Heimat war er von seinem Vater zum Zeichnen in der Natur angehalten worden und schon früh treten in seinem Werk in Ölfarbe auf Papier ausgeführte Naturstudien von Menschen und Tieren, von Pflanzen und Bäumen, von Landschaften und Genreszenen auf. Zur letzteren Gattung gehört unser kleines Gemälde, das eine Gruppe von Landleuten am Gardasee zeigt. Die stimmungsvolle, in südliches Licht getauchte Szenerie erzählt von einer Gruppe von Landleuten, die ihren Weg auf einer hochgelegenen Uferstraße unterbrochen haben, um an einer Votivkapelle zu rasten. Mehrere Personen scheinen sich vor ihr niedergelassen zu haben, größtenteils verdeckt durch einen Schimmel, während das Fuhrwerk offenbar von zwei weiteren, kaum erkennbaren Pferden (oder Maultieren?) gezogen wird. Davor ruhende Schafe vervollständigen das Bild der pittoresken Reisegruppe. Die skizzenhafte, offene Malweise Gauermanns erschwert eine genauere Kenntnis der Figuren, die er allerdings auch nicht beabsichtigt. Aus der sicher und locker skizzierten Gruppe leuchtet ein kräftiger Farbklang von Weiß, Rot und Blau heraus, der sich von der erdigen Farbigkeit des Vordergrundes abhebt. Dem Hintergrund mit dem von Bergen umstandenen See und dem von der Sonne beschienenen Himmel widmet Gauermann große malerische Aufmerksamkeit, denn er vermittelt die gewünschte atmosphärische Stimmung – nicht ohne weiteres ist dabei zu entscheiden, ob es sich um eine Abend- oder Morgenstimmung handelt. Die sich im Laufe des Tages wandelnden atmosphärischen Erscheinungen im Bild auf Leinwand oder Papier zu bannen, war die Aufgabe solch spontan hingeworfener Ölstudien. Gauermann hat das Motiv in Öl noch zweimal in ähnlicher Weise wiederholt (Bozen, Landesmuseum, Inv. Nr. S. M. 50HOP.130, und Wien, Akademie der bildenden Künste, Kupferstichkabinett, Inv. Nr. 7139). Im Frühjahr 1838 war Gauermann das erste Mal nach Italien gereist; von Triest ging die Reise über Venedig nach Südtirol. Auf dem Weg dorthin auf einer Zwischenstation besuchte er zusammen mit Joseph Höger in Rovereto den befreundeten Dilettanten Domenico de Ballarini, bei dem sie auch Quartier nahmen. Gauermann war von Rovereto begeistert und berichtete dem befreundeten Kupferstecher Friedrich Wilhelm Fink in Wien, dass er „ziemliche Studien zu einem originellen Bilde gemacht [habe]. Nämlich gerade jetzt ziehen ganze Karawanen von Hirten, die von Mantua kommen, hier durch, um den Sommer auf den südlichen Tiroleralpen zu verleben, die hier rasten, im freyen vor Rovereto bleiben und dann wieder weiter ziehen. Das ist äußerst malerisch, ganz eigene Wagen mit zwey Rädern, Maulthiere, ganze Scharen Esel mit jungen, hunderte von den schönsten Schafen und Ziegen und die Tracht auch originell. Gleich wird eine solche Siesta angefangen, bei einer Abendbeleuchtung, die ich hier so schön gesehen habe. Mehrere Skizzen mitten unter Ihnen gezeichnet.“ (Zitiert nach Rupert Feuchtmüller: Friedrich Gauermann 1807-1862, Rosenheim 1987, S. 38). Die geschilderten Eindrücke hat Gauermann genauso in einem Skizzenbuch festgehalten wie einen Besuch am Gardasee (Wien, Albertina Museum, Inv. Nr. 30583). Er verwendete diese Studien für seine Ölskizzen und weitere drei bisher bekannt gewordene Zeichnungen (St. Pölten, Niederösterreichisches Landesmuseum, Inv. Nr. 1064r und 1064v; Graz, Universalmuseum Joanneum, Neue Galerie, Inv. Nr. II/9915; Wien, Kunsthandel Hassfurther, Auktion 27.5.1999, Los 17). Die intensive Beschäftigung mit dem Thema, die Ausarbeitung der Bildidee in Zeichnung und Ölstudien lassen vermuten, dass Gauermann eine Ausführung als Gemälde plante, doch ist eine solche bislang unbekannt.

Kunsthandel H.O. Miethke, Wien, verso mit Etikett; Privatbesitz, Deutschland.

Friedrich Gauermann

1807 Scheuchenstein - Wien 1862

Vantage point on Lake Garda with the shrine to the Virgin and hor

Oil on wove, laid down on panel. 15 x 20 cm.

Die Ölskizze nahm im Werk Friedrich Gauermanns eine gewichtige Rolle ein, dokumentiert sie doch einerseits seine tiefgreifende Verbundenheit mit der Natur, andererseits sein malerisches Potential. Bereits in der Umgebung seiner Miesenbacher Heimat war er von seinem Vater zum Zeichnen in der Natur angehalten worden und schon früh treten in seinem Werk in Ölfarbe auf Papier ausgeführte Naturstudien von Menschen und Tieren, von Pflanzen und Bäumen, von Landschaften und Genreszenen auf. Zur letzteren Gattung gehört unser kleines Gemälde, das eine Gruppe von Landleuten am Gardasee zeigt. Die stimmungsvolle, in südliches Licht getauchte Szenerie erzählt von einer Gruppe von Landleuten, die ihren Weg auf einer hochgelegenen Uferstraße unterbrochen haben, um an einer Votivkapelle zu rasten. Mehrere Personen scheinen sich vor ihr niedergelassen zu haben, größtenteils verdeckt durch einen Schimmel, während das Fuhrwerk offenbar von zwei weiteren, kaum erkennbaren Pferden (oder Maultieren?) gezogen wird. Davor ruhende Schafe vervollständigen das Bild der pittoresken Reisegruppe. Die skizzenhafte, offene Malweise Gauermanns erschwert eine genauere Kenntnis der Figuren, die er allerdings auch nicht beabsichtigt. Aus der sicher und locker skizzierten Gruppe leuchtet ein kräftiger Farbklang von Weiß, Rot und Blau heraus, der sich von der erdigen Farbigkeit des Vordergrundes abhebt. Dem Hintergrund mit dem von Bergen umstandenen See und dem von der Sonne beschienenen Himmel widmet Gauermann große malerische Aufmerksamkeit, denn er vermittelt die gewünschte atmosphärische Stimmung – nicht ohne weiteres ist dabei zu entscheiden, ob es sich um eine Abend- oder Morgenstimmung handelt. Die sich im Laufe des Tages wandelnden atmosphärischen Erscheinungen im Bild auf Leinwand oder Papier zu bannen, war die Aufgabe solch spontan hingeworfener Ölstudien. Gauermann hat das Motiv in Öl noch zweimal in ähnlicher Weise wiederholt (Bozen, Landesmuseum, Inv. Nr. S. M. 50HOP.130, und Wien, Akademie der bildenden Künste, Kupferstichkabinett, Inv. Nr. 7139). Im Frühjahr 1838 war Gauermann das erste Mal nach Italien gereist; von Triest ging die Reise über Venedig nach Südtirol. Auf dem Weg dorthin auf einer Zwischenstation besuchte er zusammen mit Joseph Höger in Rovereto den befreundeten Dilettanten Domenico de Ballarini, bei dem sie auch Quartier nahmen. Gauermann war von Rovereto begeistert und berichtete dem befreundeten Kupferstecher Friedrich Wilhelm Fink in Wien, dass er „ziemliche Studien zu einem originellen Bilde gemacht [habe]. Nämlich gerade jetzt ziehen ganze Karawanen von Hirten, die von Mantua kommen, hier durch, um den Sommer auf den südlichen Tiroleralpen zu verleben, die hier rasten, im freyen vor Rovereto bleiben und dann wieder weiter ziehen. Das ist äußerst malerisch, ganz eigene Wagen mit zwey Rädern, Maulthiere, ganze Scharen Esel mit jungen, hunderte von den schönsten Schafen und Ziegen und die Tracht auch originell. Gleich wird eine solche Siesta angefangen, bei einer Abendbeleuchtung, die ich hier so schön gesehen habe. Mehrere Skizzen mitten unter Ihnen gezeichnet.“ (Zitiert nach Rupert Feuchtmüller: Friedrich Gauermann 1807-1862,

Full description on lot-tissimo.com

Alte Meister & Kunst des 19. Jahrhunderts

Auktionsdatum

Ort der Versteigerung

Für Karl & Faber Kunstauktionen Versandinformtation bitte wählen Sie +49 (0)89 221865.

Wichtige Informationen

Aufgeld und Umsatzsteuer variieren. Bitte auf das einzelne Los achten!

Aufgeld bis 500.000 €: 25 % + USt., für den Anteil von 500.000 bid 1.500.000 €: 23 %, für den Anteil ab 1.500.000 €: 18 %

AGB

Conditions of Sale Live Auction

§1 GENERAL

- These Terms of Auction are displayed in the auction room; they are published in each auction catalogue, and also on the Internet, if appropriate. By placing an order or making a bid, the buyer expressly acknowledges these Terms of Auction and the validity thereof for the auction.

- The auction, which is public as contemplated in §§ 383 III, 474 I 2 BGB, is prepared, held and handled by Karl & Faber Kunstauktionen GmbH (referred to hereinafter as “Karl & Faber“). As a matter of principle, Karl & Faber auctions the works of art as a commission agent, acting in its own name and for the account of the unnamed party supplying the object. An Auctioneer ap pointed by Karl & Faber holds the auction in the name and for the account of Karl & Faber. Claims pertaining to the auction shall be directed to Karl & Faber, and not to the Auctioneer. Objects which are the property of Karl & Faber (so-called Own Goods) are specially marked with “‡”.

§2 BIDDING AND AUCTION

- All bidders shall communicate their name and address in a timely manner before the auction. Pursuant to statutory obligations, Karl & Faber reserves the right to request economic beneficiaries to present a valid identity card, passport, or similar identifying documentation and, if necessary, any additional information in order to ascertain their identity and to make copies thereof for their records and to keep them for 30 years. Bidder numbers shall be issued, if appropriate. If a bidder wants to make bids in the name of a third party, then he must give notice to this effect before the auction begins, stating the name and address of the party he is representing and submitting a written proxy. The sales contract shall otherwise, upon the fall of the hammer, be brought about with the bidder.

- The estimate prices specified in the catalogue of Karl & Faber (where appropriate, the upper and lower estimated value) are stated in Euros. They serve as a guide for the market value of the object being auctioned. The starting price is fixed by the Auctioneer; bids shall be placed at the Auctioneer’s discretion, each price shall, as a rule, be 10 % above the preceding bid. Karl&Faber reserves the right to combine or to split catalogue numbers, or – if there is special reason for doing so – to call them in an order other than that given in the catalogue or to withdraw them.

- Bids may also be made in writing (by letter, fax, scan or via the website of Karl & Faber) or by telephone. For these purposes bidders must, in all cases, first register, using the forms provided by Karl & Faber. Bidding over the Internet (so-called ‘live bidding’) is only permissible if done via the online services and platforms provided by or approved by Karl & Faber. An additional fee of 3 % of the hammer price plus VAT if applicable will be charged for Live-Bidding via the online platforms invaluable and lot-tissimo. In accordance with the Conditions of Sale, this fee is added to the buyers premium. The bidder must bear the costs thereof. Bids made in writing or by telephone shall be only admitted if the bidder has submitted an application for the admission of such bids to Karl & Faber at least 24 hours before commencement of the auction. The request must stipulate the work of art, stating the catalogue number and the catalogue name, and must be signed. If there is any doubt, the catalogue number shall be decisive; any uncertainties shall be for the detriment of the bidder. As a rule, telephone bids shall be accepted only as of an estimated price of € 1,500. With the requesting of permission to make bids by telephone, the bidder agrees to telephone calls being recorded. Karl & Faber shall not assume any guarantee for the handling of written or internet based bids or bids made by telephone. Karl & Faber shall, in particular, not be liable for errors in transmission or for the establishment and for maintaining telephone or internet connections. This shall not apply if Karl & Faber is responsible for a mistake due to intent or gross negligence. When using a currency converter (e.g. during a live auction), no liability is assumed for the accuracy of the currencyconversion.

- The hammer shall fall, after a bid has been called three times, if no higher bid is made. If several persons make the same bid and no higher bid is made after it has been called three times, the decision will be made in favour of the first bid made or received. A bid may be accepted subject to reservation in individual cases, which the Auctioneer shall point out in each case. Any such acceptance of a bid shall only take effect if Karl&Faber confirms the bid in writing by presenting a statement of account within 8 weeks of the date of the auction; the bidder shall be bound by his bid for the duration of this period of time. Karl & Faber may withdraw its acceptance of a bid during an auction and call for new bids for the work of art at the same auction, if a higher bid made in good time has been overlooked by mistake and the relevant bidder has objected to such immediately, or if there is doubt of any other nature regarding the acceptance of a bid. If Karl&Faber exercises this right, then the acceptance of the original bid shall cease to be effective. Karl & Faber shall have the right to bid for the consignor up to the limit of a work of art. Karl & Faber shall be entitled to refuse the acceptance of a bid or to reject a bid if there is special reason on hand for doing so. A special reason shall be on hand in particular, if a bidder is unknown to Karl & Faber and has not provided security at the latest, by the time the auction begins. If a bid is rejected, then the preceding bid shall remain in effect. The acceptance of a bid shall oblige the bidder to acceptance and payment.

- Written bids shall be deemed bids already made at the auction. If Karl & Faber receives several written bids to the same amount for one and the same work of art, then the bid received first shall be accepted, if no higher bid has been submitted or is made. Karl & Faber shall only avail itself of each written bid up to the amount which is necessary in order to outbid an other bid which has been made. A written bid, which is to be submitted using the form sheet provided for such purpose, must be signed by the bidder and stipulate the hammer price (without premium, droit de suite fee, and valueadded tax due) offered for the work of art.

- Pursuant to sec. 312 (g) (2) (10) of the German Civil Code, the bidder has no right of cancellation under sec. 355 German Civil Code after the bid is awarded.

§3 PAYMENT, OBLIGATIONS OF THE BUYER TO COOPERATE IN ADHERENCE TO THE MONEY LAUNDERING REGULATIONS

-

1. The purchase price consists of the hammer price plus premium. In addition for works of art by living artists or artists who died no more than seventy years ago a fee of 1.5 % of the sum of the hammer price and the net premium, plus statutory turnover tax thereon, shall be charged to compensate for droit de suite pursuant to Copyright Act § 26..

2. As regards VAT, sales are made subject to the gross margin scheme or subject to regular taxation, depending on the consignor’s specifications to be provided in a timely fashion before the invoice is issued.

a) Artworks subject to regular taxation are marked „R“ after the catalogue number. In these cases, the buyer shall be charged a premium for each individual object as follows: 25 % on a hammer price up to and including 500,000 EUR; 23 % on the amount exceeding a hammer price of over 500,000 EUR and up to and including 1,500,000 EUR; and 18 % on the amount exceeding 1,500,000 EUR. Statutory turnover tax shall be added to the hammer price, the premium and any further costs which may be charged, and shall be separately shown on the invoice.b) When applying § 25a Value Added Tax Act (differential taxation), the premium as well as any further costs are subject to the value added tax not shown separately. The premium, taking into account the scale stipulated in the provisions of § 3 Item 2 a), shall then amount to 31.2 %, 26.32 % and 21.45 %. An "N" behind the catalogue number indicates differential taxation on works of art which originate from a country outside of the EU. For such objects, the advanced import tax will be charged at a rate of 5 % of the hammer price in addition to the premium.

- The turnover tax and the objects on which it is incurred, comply with the current state of legislation and the current practice applied for financial accounting at the time of the auction. Changes may therefore arise in this respect, which will then be passed on to the buyer. If buyers resident outside the EU take the work of art they have bought by auction with them to countries out side the EU by themselves, they must provide security amounting to the statutory valueadded tax. This will be refunded if the buyer submits the export- and purchase certificate issued by the German customs authorities to Karl & Faber within one month of receiving the work of art. (Import) sales tax and customs due abroad are in any event payable by the buyer. Invoices issued during or immediately after an auction are issued subject to review.

- Karl & Faber shall, in as far as the buyer is committed by these Terms of Auction or by legal prescription to reimburse costs and / or interest, be entitled to liquidate such in addition to the amounts as stipulated in Item § 3, Item 1, 2 a, b, 3. The purchase price shall fall due for payment upon the fall of the hammer. Default of payment shall commence two weeks after a bid has been accepted, also in the case of absent buyers, at the earliest, however, one week after the date of invoice. The purchase price shall, upon the occurrence of default of payment and notwithstanding any further claims for damages, bear monthly interest at a rate of 1 % per commenced month. Four weeks after the occurrence of default of payment, Karl & Faber shall be entitled to disclose the name and the address of the buyer to the Consignor.

- The buyer may only offset such claims with respect to Karl & Faber, which are undisputed or have been finally determined by a court of law.

- Non-cash payments shall be accepted as conditional payment. If payments are effected in foreign currencies, then any exchange rate losses shall be borne by the buyer. All taxes, costs and fees for non-cash payments (including the bank charges charged to Karl & Faber) shall be borne by the buyer, insofar as this is legally permissible and the prohibition of Section 270a Civil Code (BGB) does not apply. Karl & Faber is under no obligation to hand over the work of art which has been bought at an auction until all the amounts owed by the buyer have been paid in full.

- Billing change requests (address, taxation) cannot be accepted after the auction.

- Karl & Faber has the right, in accordance with legal obligations, to ask the purchaser to present a valid identity card, passport, similar identity document and, if necessary, further information to establish the identity of the beneficial owner, to make copies of these for its records and to keep them for 30 years. The buyer undertakes to cooperate in the fulfilment of this legal obligation.

§4 COLLECTION AND TRANSPORTATION; PASSING OF RISK; EXPORTLICENCE

- The buyer shall collect his acquisition without delay, or at the latest, two weeks after having paid his liabilities in full amount; he shall, after such time, be in default even if no reminder is conveyed. As of this date, or in any event as of the time when the work of art is handed over to the buyer, the risk of accidental destruction or of accidental deterioration of the work of art shall pass on to the buyer.

- Karl & Faber shall, notwithstanding the provisions of § 4 Item 1 above, store the work of art and insure it (at its purchase price) for a period of one month as of the date of the auction. Thereafter, Karl & Faber shall be entitled but not obliged to store the work of art at an art forwarding agency and to have it insured in the name and for the account of the buyer. If the buyer wishes to have the transportation of the work of art carried out, then he shall notify Karl & Faber thereof in writing. Karl & Faber shall organize suitable means of transportation to transfer the work of art to the buyer, and also appropriate insurance at the latter’s expense and – insofar at the buyer is acting as an entrepreneur – at the latter’s risk. Karl & Faber may request an adequate advance payment for such purpose.

- Generally speaking, the buyer is obliged to obtain any export licence that may be required in accordance with the statutory provisions. The purchaser can instruct Karl & Faber to take over the procedure necessary for the granting of an export licence. For this purpose, the purchaser must grant Karl & Faber a corresponding power of attorney for presentation to the authorities. This service is subject to a charge for the buyer and will be invoiced separately, plus any third-party costs incurred. If an export licence is not granted, the buyer is not entitled to withdraw from the contract for this reason.

§5 PASSING OF TITLE, CONSEQUENCES OF WITHDRAWAL ON DEFAULT OF PAYMENT; RIGHT OF WITHDRAWAL IN THE EVENT OF SUSPECTED MONEY LAUNDERING

- The ownership to the acquired work of art shall only pass on to the buyer after the complete payment of all amounts owed to Karl & Faber.

- If the buyer is in default of payment, then Karl & Faber may rescind the contract after having granted an additional period of respite; if such right is exercised, then all the rights of the buyer in respect of the work of art bought by auction shall expire and become void. Karl & Faber shall in such case be entitled to claim compensation of damages from the buyer in the amount of lost remuneration for the work of art (seller’s commission and buyer’s premium), and any costs incurred for catalogue illustrations. The buyer shall, in addition, be liable for transportation-, storage- and insurance costs until the work of art is returned or – as Karl & Faber may select – is put up for renewed auction. If the work of art is sold at the next auction or at the auction following next thereupon, then the buyer shall furthermore also be liable for any shortfall in proceeds. He shall not be entitled to any surplus in proceeds. Karl & Faber shall have the right to exclude the buyer from making further bids at the auction.

- If, within the framework of the usual checks, a suspicion of money laundering is found to exist on the part of the purchaser, Karl & Faber is entitled to withdraw from the contract. In this case, the buyer has no right to execute the purchase contract.

§6 PRELIMINARY VIEWING, CATALOGUE DETAILS, LIABILITY OF THE AUCTION HOUSE

- All the works of art put up for auction may be inspected and viewed in the context of the preliminary viewing. They are altogether used, and the condition they are in, particularly their state of preservation, corresponds with their age and provenance. Objections to this condition shall only be referred to in the catalogue if, in the opinion of Karl & Faber, they substantially impair the overall visual impression of the work of art. The actual condition of the work of art at the time of the fall of the hammer shall, however, in all cases be the agreed quality as defined by statutory regulations, cf. Section 6 Item 2. Frames, passepartouts, picture glass, pedestals and similar presentation aids do not belong to the work of art and are not part of the purchase con tract. Although the buyer has no claim to them, they will be provided unless instructed otherwise (except for picture glass on shipment).

- All the details given in the catalogue or in a corresponding Internet presentation are merely expressions of opinion made in accordance with best of knowledge and belief. These details do not constitute a legally binding confirmatory commitment regarding quality and nature, nor any such guarantee or an agreement on quality and characteristics. The same applies for the illustrations in the catalogue; these illustrations serve for the purpose of giving interested customers an impression of the work of art; they are not part of an agreement regarding quality and nature and do not constitute an integral part of a guarantee or an integral part of an agreement on quality and characteristics. Karl&Faber reserves the right to correct catalogue details regarding the works of art to be sold by auction before the auction. Such correction may be made by way of a written notice displayed at the place where the auction is held, or it may be given verbally by the Auctioneer immediately before the work of art is sold by auction. The corrected details shall, in any such case, apply in lieu of the description in the catalogue. All claims against Karl & Faber shall be excluded with and by these provisions, particularly all claims for damage compensation due to defects of quality and of title, as well as for other reasons [loss/damage]. This shall not apply, in as far as such claims are based on intentional or grossly negligent actions of Karl & Faber [including its vicarious agents], or if they are based on the infringement or breach of essential contractual duties, or if they concern damages due to the injury of life, body or health.

- Karl & Faber undertakes, upon the timely request of the buyer (cf. § 6 Item 4), to assert the rights and claims provided for under the internal relationship with the Consignor against such Consignor – also before court if necessary – if the buyer has proven that the details given in the catalogue regarding the origination and the technique of the work of art bought at the auction are incorrect were also not in agreement with a generally recognised expert (or the creator of the catalogue of works, the declaration of the artist him/herself or the artist’s trust) on the date of the auction. If claims are successfully asserted against the Consignor, then Karl & Faber shall refund the purchase price to the buyer if there are no third-party rights on hand to the work of art, and if the work of art is returned in unchanged condition at the registered headquarters of Karl & Faber.

- Any and all claims asserted against Karl & Faber shall become statute-barred one year after the work of art has been handed over to the buyer. This shall not apply for the claims regulated by the provisions stipulated in § 6 Item 2., last sentence; these shall become statute-barred within the periods as provided for by law.

§7 POST-AUCTION SALE

These Terms of Auction shall also apply mutatis mutandis for the subsequent offhand sale of works of art (so-called After or Post Auction Sale) on the open market. Karl & Faber may, for such sales, particularly impose and charge the considerations and allocations regulated in § 3. For this off-hand sale, which is part of the auction, the Distance Selling Regulations according to §§ 312 b) et seqq. BGB does not apply.

§8 FINAL PROVISIONS

The laws of the Federal Republic of Germany shall apply exclusively. The United Nations Convention on the International Sale of Goods (CISG) shall not apply. Munich shall be the place of performance and venue, insofar as the same may be admissibly agreed. If one or several provisions of these Terms of Auction should be or become invalid, then the validity of the remaining other provisions shall not be affected thereof. These Terms of Auction shall govern all relations between the buyer and Karl & Faber. General terms and conditions of business of the buyer shall not apply. No verbal ancillary agreements have been concluded. Amendments to these Terms of Auction are to be made in writing; this shall also apply for the relinquishment and waiver of this writing requirement. If the Conditions of Sale are available in several languages, the German version shall always prevail.

Revised: June 2020